A Neptune Flood Insurance Agency in New Jersey

When you choose Neptune, you get enhanced coverage that can save up to 25% off your premium, for exactly the same coverage as your NFIP policy. Neptune’s greater coverage options allow you to tailor your policy to cover more of your assets. These options, not available through the NFIP, include replacement cost, temporary living expense, basement contents, pool repair/refill and detached structures. Neptune also provides higher limits of coverage, up to $4,000,000 for your home and $500,000 for contents, compared to $250,000/$100,000 with the NFIP. Finally, there’s a reduced waiting period at Neptune – only 10 days vs. the 30-day waiting period under the NFIP. For a loan transaction, there’s no waiting period.

Why Neptune Flood?

The Neptune Advantage

Neptune Residential Flood offers coverage to protect you for items not covered in the National Flood Insurance Program, such as the contents of your basement, structures not attached to your home such as a garage, pool house, or shed, grills and pools, and greater amounts for your home and contents.

What’s Covered?

A standard flood insurance policy covers your home and contents when damage is caused by rising water. At Neptune, we help waterproof your assets by offering expanded, optional coverage that gives your family protection where other insurers may literally leave you “underwater.”

Standard Coverages

- Building, which is the insurance on the primary home/building on the insured property.

- Personal Contents, which is the insurance that protects the possessions inside of your home.

The coverage offered in a Flood Insurance policy may sound like the coverage you already have in your Homeowner’s policy, but that’s not the case. It’s different than your Homeowner’s insurance because a typical Homeowner’s policy specifically excludes water damage that results from rising water. For the purpose of insurance, “Rising” is the key word to distinguish flood damage from water damage.

Low Risk Doesn’t Mean No Risk

Residential Flood: Many homeowners believe that they only need flood insurance if their mortgage company or bank requires it, which is mostly when the home is located in areas categorized as “high risk” (flood zone A or V). The fact is, you don’t need to live on the coast to be at risk. Wherever it rains, it can flood, regardless of your proximity to a body of water.

Commercial Flood: If you have a Small Business Administration loan you are required to have flood insurance if you are in a high-risk flood zone. Many other lenders require flood insurance on your commercial building if you are in a high-risk flood zone – A and V flood zones.

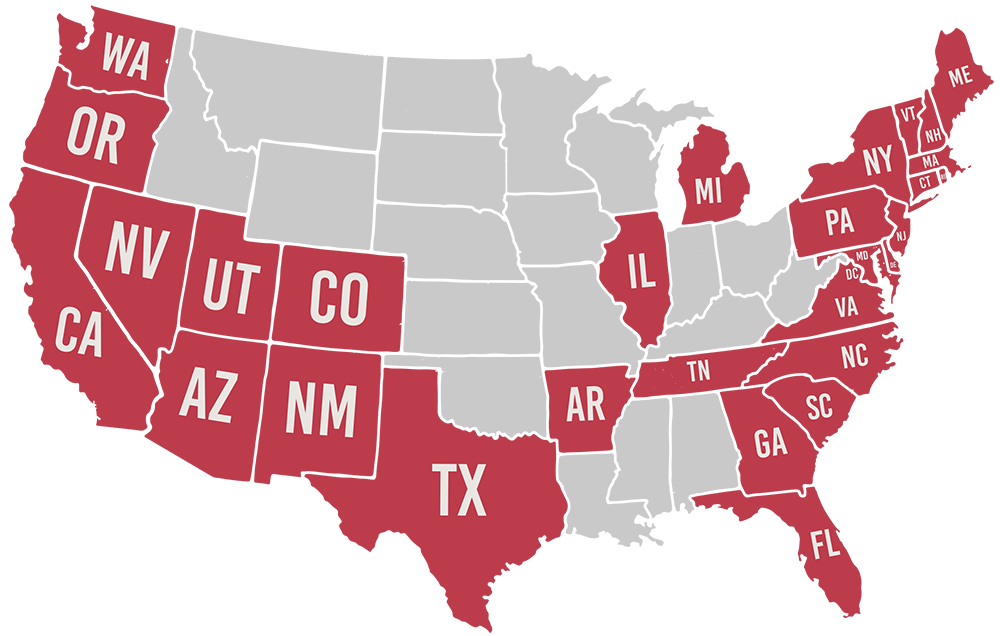

Available in all states except Alaska & Kentucky

Licensed in 29 States