Insurance for Hair Salons, Barbershops, and Nail Salons in NJ, NY, CT, PA and Other States

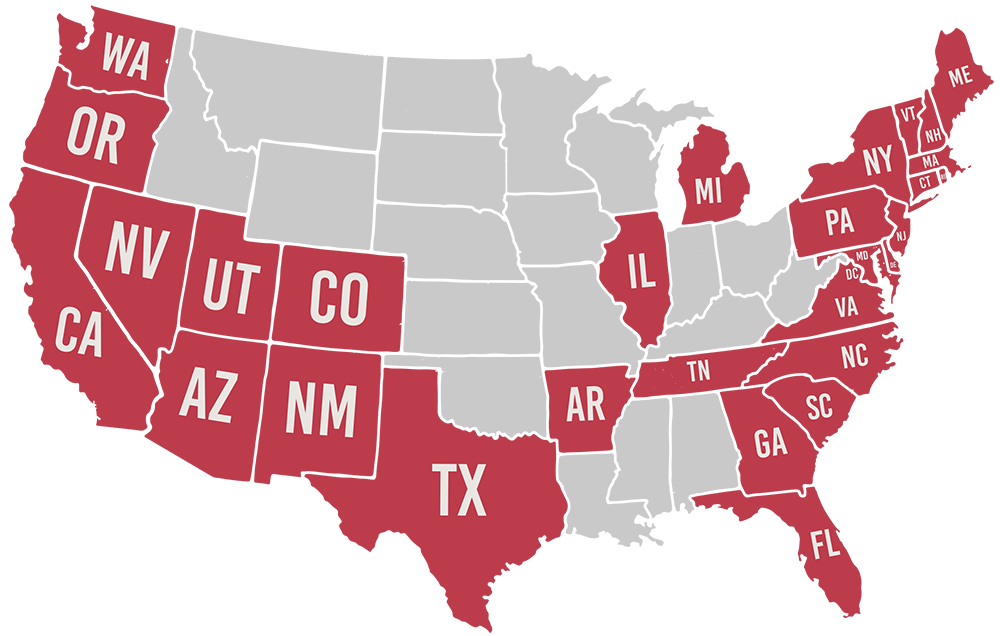

At your salon or barbershop, your clients depend on you to help them look their very best. To keep them fully satisfied, you need complete confidence in your property, equipment, and employees before you can promise the highest-quality service. That’s why it’s vital to protect your business, assets, and clients with salon insurance from Muller Insurance. We serve salons and barbershops across New Jersey, New York, Connecticut, Pennsylvania, Nevada, and throughout the United States with tailored policies to keep your shop or salon protected.

Types of Coverage

Salons and barbershops are businesses first, so they require some of the same standard coverages as any other company. Many salons start with a business owner’s policy, or BOP, which combines coverage for the following types of expenses into a single, convenient plan:

- Business property: This coverage type protects your business-owned buildings property against damage and extra expenses incurred from sewer backups or catastrophes.

- Equipment breakdown: Salon and barbershop equipment is often expensive. When it breaks down due to power surges or burnout, it helps to be covered.

- Lost income: You’ll be protected if you lose income due to temporarily closing your salon after a covered event.

- General liability: Though salons might not seem dangerous, they serve large numbers of clients. This can leave you vulnerable to lawsuits. When a client slips on a wet floor or has an allergic reaction to a product, general liability insurance covers you.

| TYPE | DETAILS |

|---|---|

| Business property | This coverage type protects your business-owned buildings property against damage and extra expenses incurred from sewer backups or catastrophes. |

| Equipment breakdown | Salon and barbershop equipment is often expensive. When it breaks down due to power surges or burnout, it helps to be covered. |

| Lost income | You’ll be protected if you lose income due to temporarily closing your salon after a covered event. |

| General liability | Though salons might not seem dangerous, they serve large numbers of clients. This can leave you vulnerable to lawsuits. When a client slips on a wet floor or has an allergic reaction to a product, general liability insurance covers you. |

Some shops and salons may need other types of policies as well, depending on the services offered. In addition to a BOP, owners in the beauty industry often consider the following coverage:

- Professional liability: Available for licensed stylists, professional liability provides coverage in the event of negligence or other claims brought by clients.

- Commercial auto: If your salon runs house visits or on-location services, then you’ll need commercial auto insurance to cover the vehicles owned by the company.

- Workers’ compensation: If any of your stylists, massage therapists, barbers, or other employees are injured or become ill while working, then workers’ compensation insurance is essential to cover the cost of their hospital visits and missed income.

- Umbrella: A commercial umbrella policy offers extra coverage beyond the limits of your general liability and commercial auto policies and may cover additional claims.

| TYPE | DETAILS |

|---|---|

| Professional liability | Available for licensed stylists, professional liability provides coverage in the event of negligence or other claims brought by clients. |

| Commercial auto | If your salon runs house visits or on-location services, then you’ll need commercial auto insurance to cover the vehicles owned by the company. |

| Workers’ compensation | If any of your stylists, massage therapists, barbers, or other employees are injured or become ill while working, then workers’ compensation insurance is essential to cover the cost of their hospital visits and missed income. |

| Umbrella | A commercial umbrella policy offers extra coverage beyond the limits of your general liability and commercial auto policies and may cover additional claims. |

Policies We Offer

Salons are challenging to run and insure, with high risks associated with wet floors, beauty products, and expensive equipment. It’s essential to partner with an insurance company with the experience and care to meet these unique challenges. As an independent provider, Muller Insurance can choose between policies from numerous insurers to help your business acquire the coverage it needs. We offer policies from The Andover Companies, Chubb, Plymouth Rock, Travelers, and many more.

Choose Muller Insurance

Trust Muller Insurance to protect your shop or salon. We have over a century of experience providing the right coverage to hair salons, barbershops, and nail salons in New Jersey, New York, Connecticut, Pennsylvania, Nevada, and many other states. Thanks to our local focus, we’re able to provide the personal level of attention and care you deserve. To find out more about salon insurance coverage, contact us today and request a free quote.

Licensed in 29 States