Owner-Occupied Dwelling Insurance in NJ, NY, CT, PA and Other States

Living in a unit in the residential building you own is a great way to cut costs and combine expenses, all while staying nearby tenants who might need you. To ensure your complete peace of mind, don’t forget to invest in owner-occupied multi-family insurance. Offered by Muller Insurance, our affordable policies cover your belongings and building from listed events. We provide policies to clients in multiple states, including New Jersey, New York, Connecticut, Pennsylvania, and Nevada.

What Is Owner-Occupied Dwelling Insurance?

Owner-occupied dwelling insurance is a unique type of property coverage. If you own a building with multiple family units, and one of which is your primary residence, this policy type is for you. Like a homeowners policy, owner-occupied dwelling insurance protects you and your personal belongings. It covers the following:

- Smoke and fire damage

- Snow, hail, and storm damage

- Theft and vandalism

- Overall building structure

- Common areas (entrances, roofs, hallways, elevators)

- Floors, walls, and ceilings of tenant-occupied spaces

The residents of the building’s other rental units are responsible for purchasing their own renters insurance to protect personal belongings.

What Additional Coverage Options Are Available?

For many property owners, a standard owner-occupied dwelling insurance policy is sufficient. Others, however, may want to invest in further coverage. Every property is unique, requiring different forms of protection against the risks that pertain to it, which is why many building owners consider the following add-ons:

- Flood insurance: Many standard dwelling policies don’t protect against floods, making additional insurance a wise investment for buildings near bodies of water.

- Earthquake coverage: Earthquake damage is also not covered by standard policies. If your property is in an at-risk area, it’s wise to invest in additional coverage in case of disaster.

- Jewelry, fine arts, and collectibles: If you keep high-value items in your apartment, consider additional coverage to protect them against danger. This can include antiques, fine wine, rare collectibles, and other priceless belongings.

- Umbrella insurance: Anyone can be hit by a lawsuit, but rental properties come with a higher risk than most. Umbrella insurance extends the limits of your liability protection when problems end up in court.

- Workers’ compensation: If you hire employees to maintain the building or grounds, workers’ compensation may be required. It’s also a useful resource to get employees back on their feet if they’re hurt on the job.

Finding the Best Policy for Your Needs

Muller Insurance is an independent agency, which allows us to work with dozens of different providers to find you the right coverage at the best price for you. These insurers include top names including the following:

Numerous options allow us to work closely with clients to establish their exact coverage needs, taking into account their preferences and budget. We know every property is unique, and your owner-occupied, multi-family dwelling insurance policy from Muller Insurance will be tailored to your building alone. To learn more or to request a quote for your owner-occupied dwelling policy in New Jersey, New York, Connecticut, Pennsylvania, Nevada, or the other states we serve, contact us today.

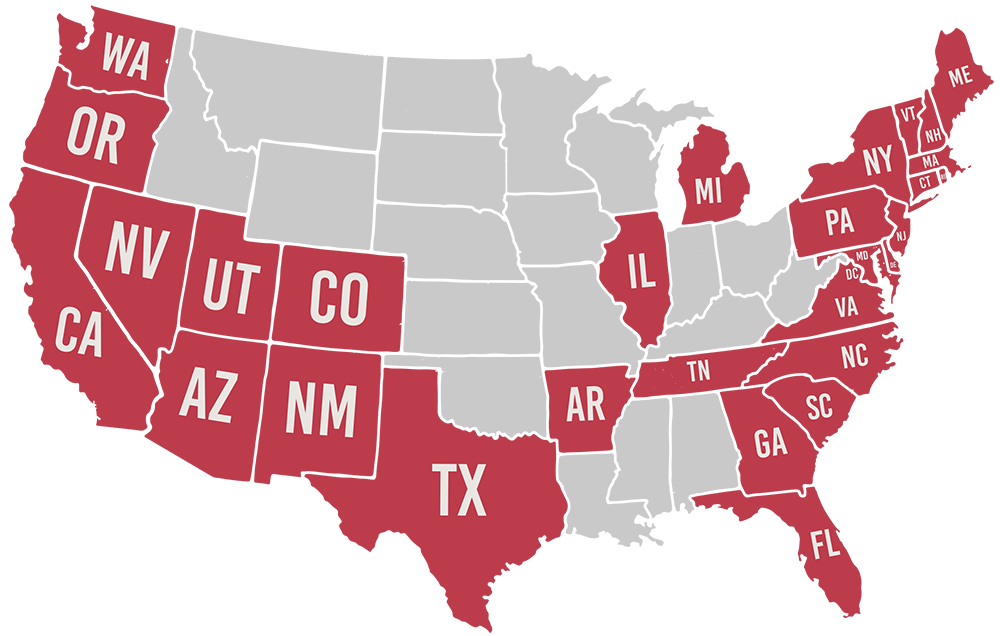

Licensed in 29 States

Additional Resources

Responsibility in a Multi-Family Dwelling

There are many variations of multi-family dwellings, each with their own nuances when it comes to liability. Before you buy a multi-family residential property, make sure you know the differences

What You Need to Know about Multi-Unit Insurance Coverage

If you own a building with multiple private units or are seeking to rent out separate living spaces to potential tenants, you need to find out which form of insurance

Does Homeowners Insurance Cover Multiunit Dwellings?

Multiunit dwellings may require unique coverage, and several insurance options are available. Whether you’re a homeowner who’s renting out one-half of a two-family home or multiple living spaces, you need