Flood Insurance for Properties in NJ, NY, CT, PA and Beyond

Did you know that standard homeowner insurance policies do not cover damages caused by flooding? Many people don’t, which can lead to added heartache and trouble in the event of major storms. That’s why when it comes to finding reliable flood insurance, property owners from New Jersey, New York, Connecticut, Pennsylvania, Nevada, and across the country to turn Muller Insurance.

We can make sure that in the event of flooding, you’ll have coverage that gives gives you Actual Cash Value of your property’s structure. In addition, we’ll also make sure your policy provides the estimated cash value for any possessions that were lost or damaged due to the flood.

We’ll also make sure you understand the scope of your flood insurance. For example, the cash value for your possessions takes into account depreciation, meaning the amount of cash you will receive for an item depends on how old it is. Also, furniture and other types of items that are stored in basements may only be partially covered.

Live on the coast or in a flood zone?

Everyone realizes they need home insurance. But recent weather patterns tell us that flood insurance is becoming increasingly important, especially for people living near coastal areas or designated flood zones. This includes people living inland near rivers or who may even be impacted by melting snow. But don’t wait until it is too late. Remember, every policy has a 30-day waiting period before it goes into effect.

Is Your Area Flood Susceptible?

Whether you are in need of a standard insurance policy or excess flood insurance, NJ is home to our experienced representatives. Our team can help you find the coverage you need to ensure your property is protected.

Don’t risk waiting another day without the proper coverage.

Muller Insurance works with many insurance providers, including trusted companies like Wright Flood, Selective Flood and many others. Contact Muller Insurance in Hoboken to learn more!

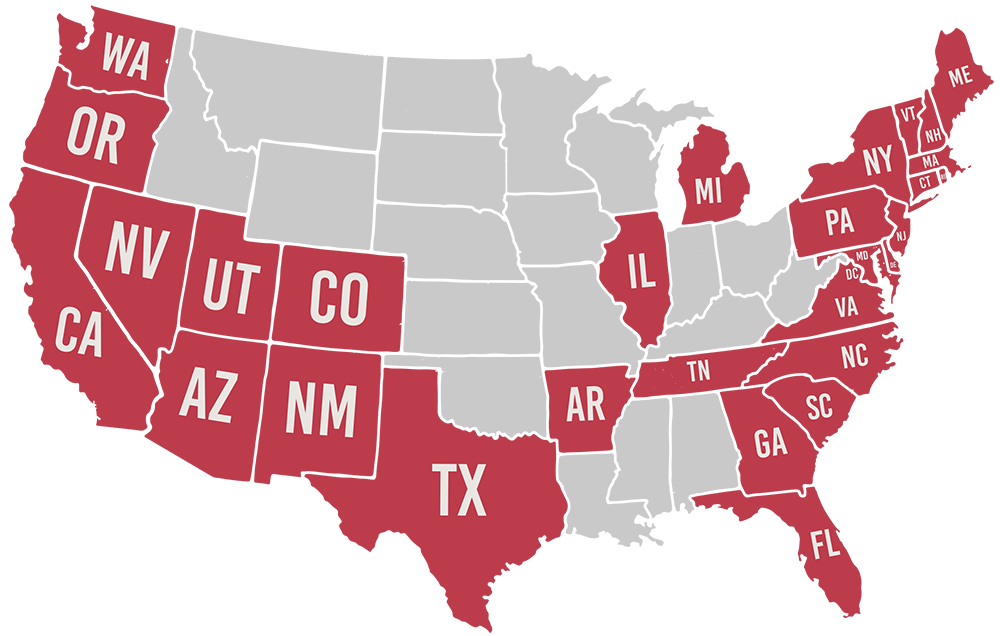

Licensed in 29 States

Additional Resources

Flood Insurance and Your Basement

When you imagine floodwater affecting your home, you may first think of the main floor. The basement, however, often sees the worst of flooding. This is a significant problem because

No Flood Insurance? Don’t Get Swamped

Five Points To Consider It should be obvious to just about everyone that having insurance to protect your property against flooding from severe storms, overflowing rivers or even melting snow

Why You Need Flood Insurance

As a homeowner, you always take the necessary steps to protect your property, from maintenance and repairs to a comprehensive homeowner’s insurance policy. If those steps don’t include flood insurance,