A Selective Flood Insurance Agency in New Jersey

When you choose Selective, you choose more than an insurance policy. You choose insurance professionals who are there for you before, during and after the insurance claim. Selective provides flood building and contents insurance coverage for both home and business properties nationwide.

Why Selective Flood?

Best in Class Customer Service

Responding to you is not just a top priority! Selective offers you a number of ways to pay your bill, get information about your policy, or get answers to your questions. From online, to mobile, to telephone – they’re there for you when you need them.

Superior Claims Service

No one wants to have an insurance claim, but sometimes they can’t be avoided. When the unthinkable happens, Selective insurance claims professionals will help you through the claims process and respond to your needs in a timely and professional manner.

Best in Class Customer Service | Superior Claims Service |

|---|---|

| Responding to you is not just a top priority! Selective offers you a number of ways to pay your bill, get information about your policy, or get answers to your questions. From online, to mobile, to telephone – they’re there for you when you need them. | No one wants to have an insurance claim, but sometimes they can’t be avoided. When the unthinkable happens, Selective insurance claims professionals will help you through the claims process and respond to your needs in a timely and professional manner. |

Residential Flood Insurance

Don’t wait until it’s too late

Floods are one of the most frequent natural disasters, and can impact anyone, anywhere, at any time. Since standard insurance policies don’t typically cover flooding, it’s important to be prepared by protecting your home with valuable personal flood insurance.

Selective and Muller Insurance have a unique approach to delivering personal flood insurance policies through the National Flood Insurance Program (NFIP). Whether you’re located in a high-risk, or moderate-to-low risk area, Selective and Muller Insurance can help assess your risk of flooding from rainfall, snow melt, river-flow, tidal-surges, and more.

Commercial Flood Insurance

The impact from a flood can be devastating. Even if your business isn’t in an area historically prone to flooding from waters rising nearby, that doesn’t mean you can’t be affected by a flood. We’ve all seen the historic rain and snowfalls that lead to flooding in the news. The fact is, floods can happen anywhere, and your business insurance might not provide enough coverage for your losses.

Flood insurance is not automatically included under a business insurance policy. This coverage is administered by the National Flood Insurance Program (NFIP) and needs to be purchased as separate, additional coverage.

Excess and Private Flood Insurance

Specifically designed for residential or commercial business owners who have the maximum amount of coverage available under the National Flood Insurance Program (NFIP) but need additional excess coverage to protect their higher-valued assets.

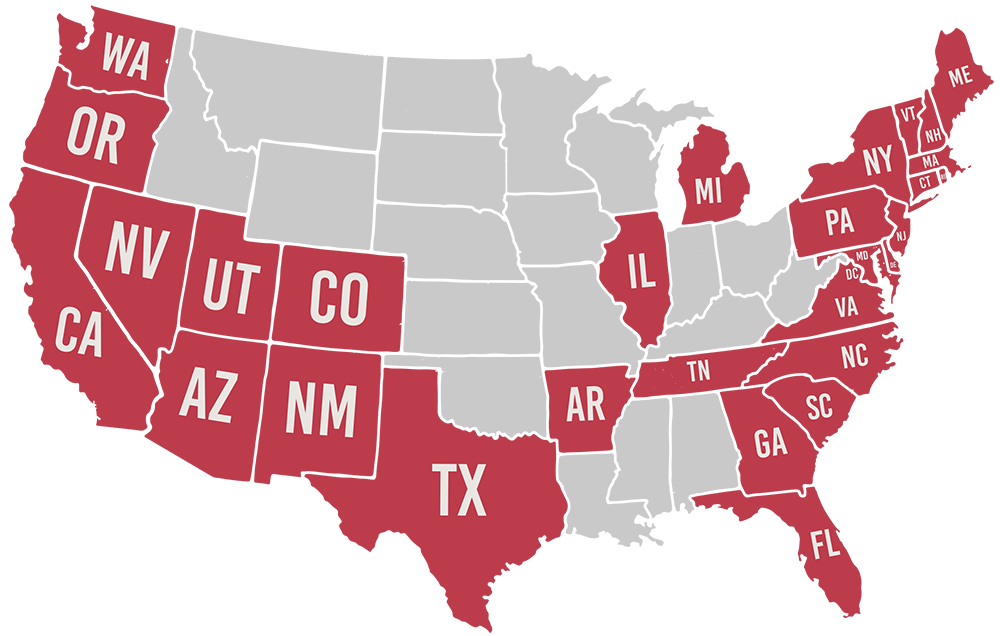

Available in NJ

Licensed in 29 States