Insurance for Businesses in NJ, NY, CT, PA and Beyond

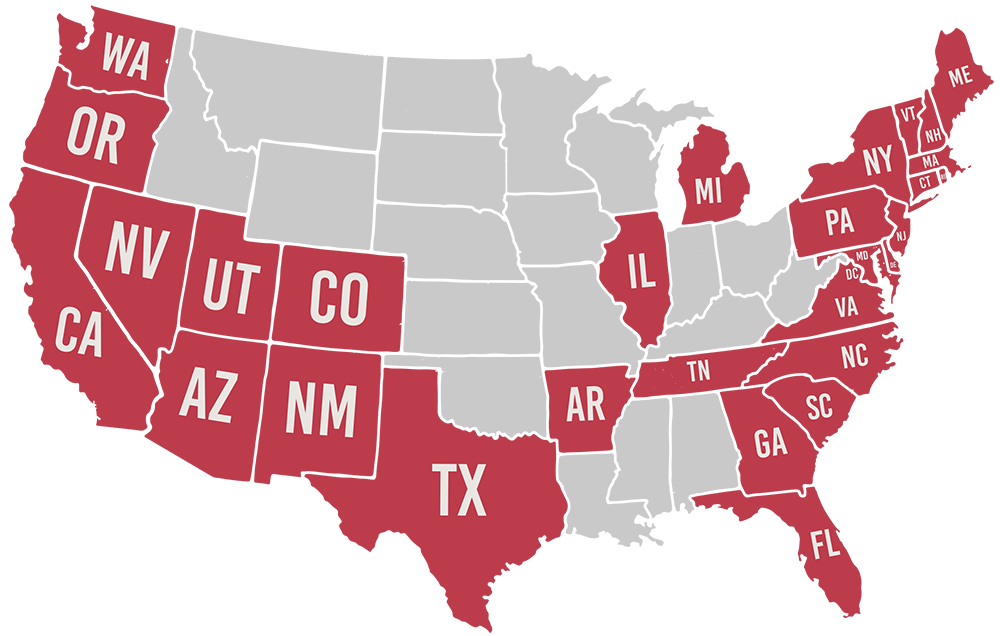

Whether you run a home-grown enterprise or a large corporation, you work hard to make your business succeed. With all your effort and ingenuity, however, everything you’ve built can still be wiped out with just one disaster. Ensure your peace of mind and company’s stability with the right policy from Muller Insurance. We offer our clients quality business insurance policies in New Jersey, New York, Connecticut, Pennsylvania, Nevada, and in 25 other states that can fully protect your assets in the face of lawsuits, workplace accidents, and more.

Business Owner Policy Coverage

At Muller Insurance, our business insurance packages offer flexibility by combining protection for your major property and liability risks into one convenient policy. You also have the option to purchase coverages separately based on your business’ needs, such as our restaurant/café insurance. We specialize in securing the right coverage for companies in all industries, from restaurants, salons, barbershops, and nail salons to marketing firms, major retailers, and more.

Ideal for small and mid-sized companies, standard business owner policies (BOPs) offer the following types of coverage:

- Property insurance: covers the property owned by the company and their contents

- Business interruption insurance: covers the loss of income in the event of a shutdown due to a covered loss

- Liability insurance: covers the company’s legal responsibility for bodily injury or property damage that occurred on company grounds or as a result of employee actions

BOPs do not cover professional liability, commercial auto, workers’ compensation, or health and disability insurance. If you need these kinds of protection, you may want to purchase additional commercial coverage or customize your existing policies to meet the special risks you face.

Policies We Offer

Muller Insurance has been an independent company for over a century. This means we pick and choose our policies from a long list of providers to help you find the right coverage for your company’s unique needs. In addition to names like Progressive, Franklin Mutual, and Fidelity, we offer policies from the following premier companies and many more:

As a local provider, we can give your business the close attention necessary to understand its unique needs. We then select from dozens of policies to find you the best fit. We’re independent and not beholden to any single insurance provider, so we have the freedom to choose between multiple companies so your business can have the coverage it needs.

Protect Your Business with Muller Insurance

Don’t let one disaster wipe out the product of all your hard work and ingenuity. Protect your livelihood with a business insurance policy from Muller Insurance. With policies suitable for businesses of all sizes, we are dedicated to finding and providing high-quality coverage without high costs. We are licensed in 25 states, including New Jersey, New York, Connecticut, Pennsylvania, and Nevada, and our team is standing by to assist. To find out more about business insurance, contact us today and get started now with a free quote.

Licensed in 29 States

Additional Resources

Small Business Insurance Tips

Small business owners are dedicated to their businesses, often putting much of their resources and time into making them work. Because of this, it is essential to have the right

Barbershop Owners’ Insurance Responsibilities

Insurance Responsibilities of Barbershops Barbers sometimes work alone, rent a chair in a salon, or hire their own employees at a shop. Whatever the case, it’s up to barbering business

Home Businesses Have Unique Insurance Needs

If you run a business out of your home, it’s important to remember that your standard homeowners insurance policy does not cover losses from your home-based business. In fact, a