Workers’ Compensation Insurance for Business Owners in NJ, NY, CT, PA and Beyond

When an employee gets injured on the job, it doesn’t just affect them. It affects their employer, too. Not only do you have to compensate for lost productivity, but you may also be financially responsible for their injury. To help protect your assets, it’s imperative to have a good workers’ compensation policy through an agency you can trust to keep you and your employees safe. To discuss policies for your business, contact Muller Insurance today.

Workplace Illness and Injury

In most states, workers’ compensation is mandatory—even for small and low-risk businesses. That’s because work-related injury or illness can happen to anyone, anywhere. People with jobs that are considered dangerous, like construction workers, police officers and electricians, may be most at risk for severe injury. But even employees who work in a cubicle all day are at risk.

The most common types of workers’ compensation claims involve falls, overexertion, repetitive motion, violence, transportation and exposure to dangerous substances, among others. Regardless of why or how an employee gets injured, workers’ compensation can help.

What Does Workers’ Compensation Cover?

Workers’ compensation insurance for employees cover the costs of medical bills, recovery/rehabilitation needs and some of their lost wages.

For business owners, workers’ compensation can also help you with legal expenses and educate you on how to mitigate risks, so that you can prevent injuries from happening in the first place. The insurance agent should also review the policy with you on a regular basis to make sure any changes are accounted for. If and when claims do come up, the insurance company helps you do a thorough review to make sure all evidence is correct.

Simplify Workers’ Compensation with Muller Insurance

The idea of workers’ compensation can be stressful and overwhelming, but it doesn’t have to be. With a good insurance policy, you’ll be able to help your employees get back to work, vet out any wrongful claims and protect your business financially. Serving clients in New Jersey, New York, Connecticut, Pennsylvania, and Nevada, contact Muller Insurance online or by phone at 201-659-2403 to discuss your options.

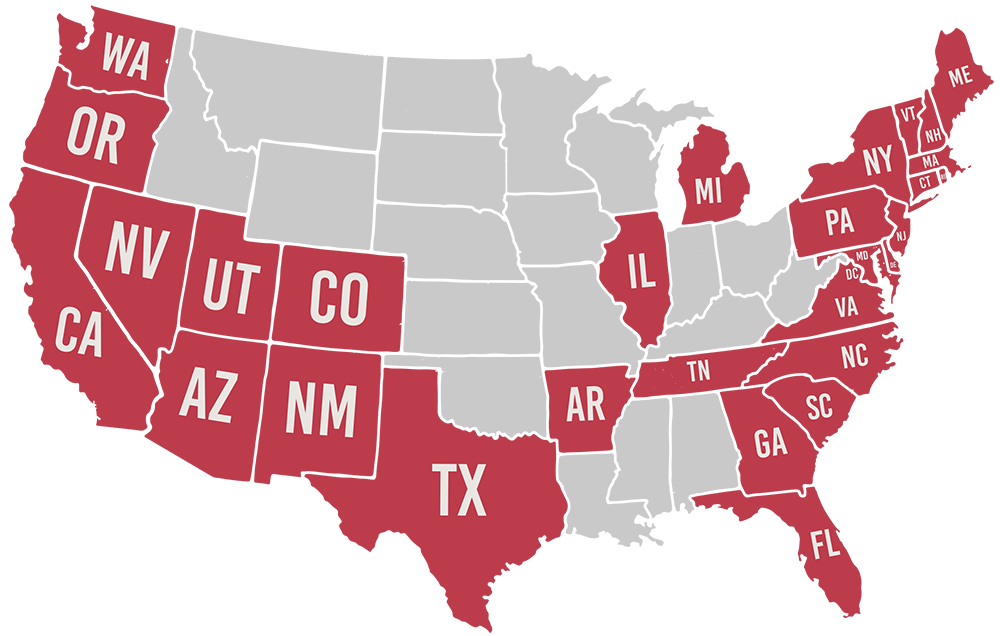

Licensed in 29 States

Additional Resources

Barbershop Owners’ Insurance Responsibilities

Insurance Responsibilities of Barbershops Barbers sometimes work alone, rent a chair in a salon, or hire their own employees at a shop. Whatever the case, it’s up to barbering business

Avoiding Risk: How Insurance Protects Small Contractors on the Job

For a small business contractor, even a single accident or unexpected claim can cause serious financial strain. Whether you handle plumbing, electrical work, or other specialty repairs, having the right

Essential Insurance Policies Every Small Contractor Needs

If you’re a small contractor, whether in carpentry, electrical work, or plumbing, your business faces occurrences every day. From job site accidents to property damage, the right insurance coverage isn’t