Insurance for Co-Op Apartments in NJ, NY, CT, PA and Beyond

If you own a co-op apartment, you can protect your assets from theft, burglary, fire and more with co-op insurance. Because you don’t own the property, but rather a share of the corporation, it’s important to make sure you’re covered in case the unexpected happens. The agents at Muller Insurance can help –contact us today for more information about policies and protection plans.

What Is Co-Op Insurance?

The co-op building itself already has insurance for natural disasters, utilities and common areas, like elevators. However, it’s up to the individual shareholders to protect their own unit and personal belongings. That’s where co-op insurance comes in. If your personal property gets stolen or damaged, you can submit a claim to receive appropriate reimbursement.

The second part of co-op insurance is liability. If someone falls inside your individual apartment and gets injured, they can file against you. But with liability coverage, you’ll be protected if they do.

The Benefits of Co-Op Insurance

One of the unique things about co-op insurance is that it allows multiple shareholders to purchase insurance as a group. As someone with stakes in the entire corporation, there’s more personal risk in case something were to happen. For that reason, many owners like to join together. The conjoined policy is often more extensive than an individual plan, giving shareholders better coverage, but for an affordable rate.

What Else You Need to Know

Before purchasing co-op insurance, it’s important to look into the building’s insurance plan. What’s already covered? What’s not? Examine the fine print to make sure there are no loopholes. For example, the master insurance plan may not cover certain structures or damages you think it might.

It’s also important to note that some types of damage, like flooding, usually require a separate insurance policy. Flood insurance in particular is especially critical for New York City and Hoboken residents. Another one is water and sewer backup insurance, but luckily, Muller Insurance already covers that for homeowners — no separate policy needed. As you select your insurance policy, make sure you take all the necessary precautions to protect yourself and your co-op apartment.

Talk to the Co-Op Experts

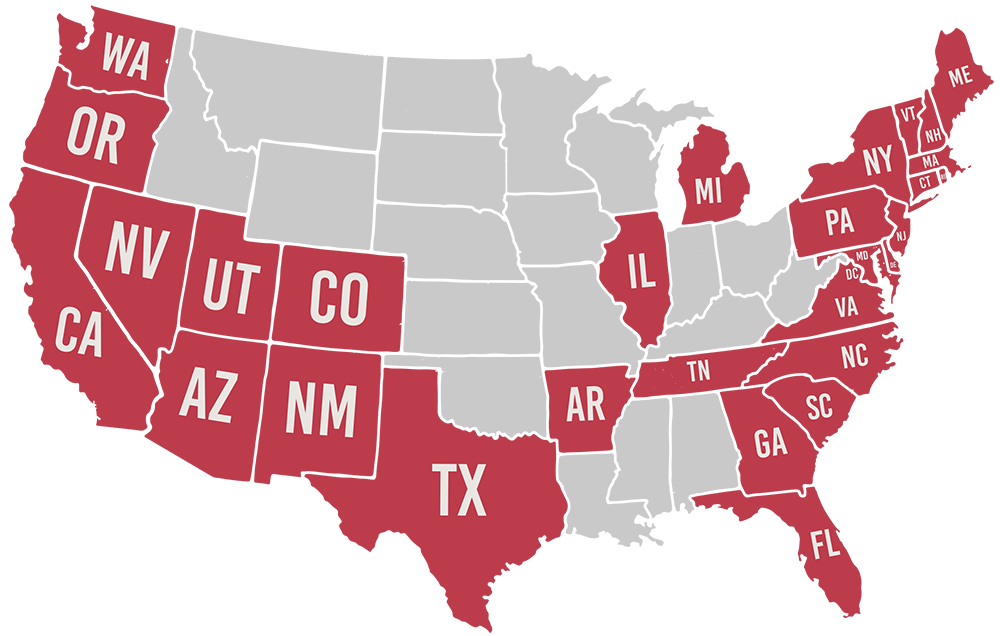

Having served the greater Hoboken area for more than a century, and offering coverage throughout New Jersey, New York, Connecticut, Pennsylvania, Nevada, and other states, Muller Insurance knows all the ins and outs of co-op insurance. Get in touch with us today to learn more about the policies available and to get the protection you need.

Licensed in 29 States

Additional Resources

Handling Uninsured Condo Owners

Operating a building with condos offers stability from the tenants and a steady stream of rent. However, if the tenants are allowed to rent the condos instead of own them,

Safety in Numbers: The Power of Bundling Condo and Renters’ Insurance

Having insurance is important in case anything happens to your condo, dwelling, or your possessions. An insurance policy can cover natural disasters, like a fire, and protect your belongings from

From Residential to Commercial: Ensuring Adequate Coverage With Mixed Condo Insurance

Mixed-use properties have become increasingly popular as a way to optimize rental income while boosting community appeal. Insuring them, however, comes with hidden complexities. Mixed-use property insurance is more than