Dwelling Insurance in NJ, NY, CT, PA and Other States

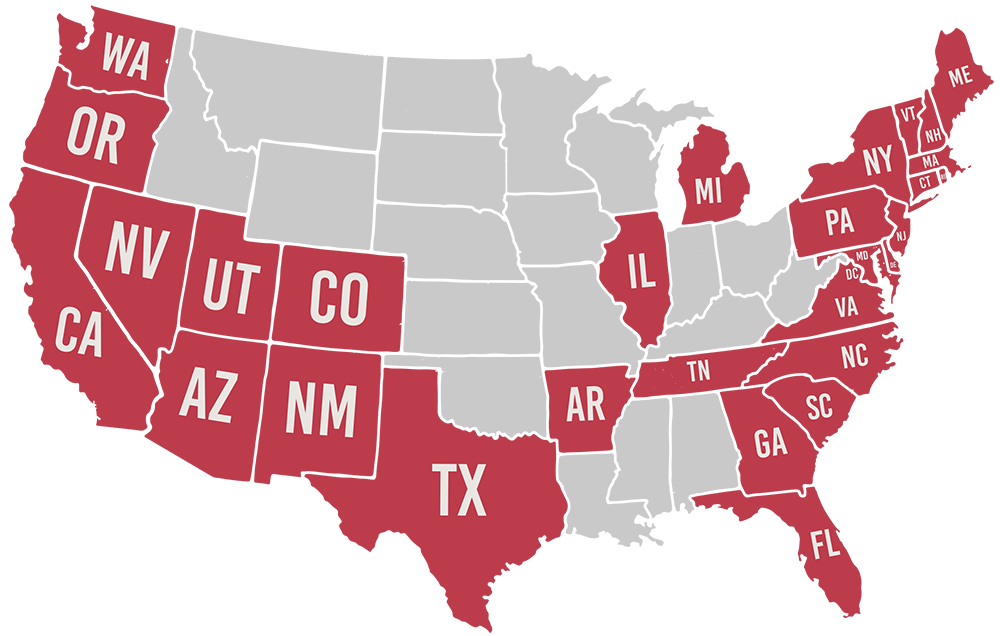

According to the legal definition, a dwelling is a self-contained accommodation used by multiple households. Shared buildings like this are an excellent solution to limited space in urban areas, but they can be difficult to insure. That’s where Muller Insurance comes in, offering dwelling insurance specially designed to protect properties like this. In New Jersey, New York, Connecticut, Pennsylvania, Nevada, and other states, we work with multi-family dwelling building owners to help them find policies to fit their unique needs.

What Does Dwelling Insurance Cover?

Muller Insurance offers two types of dwelling insurance policies based on who the building’s occupants are, including:

- Owner-occupied dwelling insurance: These policies are designed for three- or four-family properties where the owner occupies one of the units.

- Tenant-occupied dwelling insurance: If the owner does not occupy the building, a tenant-occupied dwelling policy is appropriate.

Both policy types start with the building itself. In case of disaster, the policy will cover the cost of repairing or replacing elements of the building that have been damaged. Protection extends to the building’s structure, essential systems like plumbing or heat, and common areas. It also covers items that belong to the building’s owner, like maintenance supplies or appliances. For landlords, the right insurance can even supplement income lost while the building is uninhabitable after a disaster.

In addition to property protection, dwelling insurance policies also include premises liability and medical protection. This covers physical property damage or injury that occurs to guests who are visiting your building. As the building’s owner, you may be held responsible – so it’s best to have insurance to cover the cost.

What Other Coverage Options Are Available?

We understand every property is unique, and not every client will be fully protected with a standard policy. In response, we offer ways to extend protection for your multi-family residential building, including the following:

H3: Flood Insurance

If your dwelling is located near a body of water, it may be at risk from floods. Standard dwelling insurance does not cover flood damage, which is why you should consider investing in specialized flood protection.

H3: Earthquake Insurance

Because damaging earthquakes are only likely in certain areas, a standard policy doesn’t protect against them. You should invest in special earthquake coverage if your dwelling is in a region that frequently experiences earthquakes.

Owning a rental property comes with the risk of a lawsuit for mismanagement – even for careful owners. Umbrella insurance is a valuable tool that can help pay for legal fees and court-assigned judgments.

If you employ a building superintendent or other type of maintenance worker, workers’ compensation is most likely required by your state. It can also keep your employees healthy and help them return to work sooner when they get hurt or sick on the job.

| Coverage | Description |

|---|---|

| H3: Flood Insurance | If your dwelling is located near a body of water, it may be at risk from floods. Standard dwelling insurance does not cover flood damage, which is why you should consider investing in specialized flood protection. |

| H3: Earthquake Insurance | Because damaging earthquakes are only likely in certain areas, a standard policy doesn’t protect against them. You should invest in special earthquake coverage if your dwelling is in a region that frequently experiences earthquakes. |

| H3: Umbrella Insurance | Owning a rental property comes with the risk of a lawsuit for mismanagement – even for careful owners. Umbrella insurance is a valuable tool that can help pay for legal fees and court-assigned judgments. |

| H3: Workers’ Compensation | If you employ a building superintendent or other type of maintenance worker, workers’ compensation is most likely required by your state. It can also keep your employees healthy and help them return to work sooner when they get hurt or sick on the job. |

Securing the Best Policy for Your Building

Muller Insurance works with many insurance providers, including trusted companies like Chubb Insurance, Plymouth Rock Insurance, Travelers Insurance, The Andover Companies, Franklin Mutual, Safeco, Farmers of Salem, Narragansett Bay, Cumberland Mutual and many others. Our independent status allows us to select from a range of options and plans, meaning when we consult with our clients, we’re able to find them the policy that meets their custom needs and budget. To learn more about dwelling coverage or to request a quote, contact us today for coverage in New Jersey, New York, Connecticut, Pennsylvania, Nevada, and the other states we serve.

Licensed in 29 States