Disability Insurance for Residents of NJ, NY, CT, PA and Beyond

Disability insurance provides added financial security by paying an insured person an income when that person is unable to work because of an accident or illness. It is not surprising that disability insurance is critical. Consider that at age 40, the average worker faces only a 14-percent chance of dying before age 65. That same worker, however, faces a 21-percent chance of being disabled for 90 days or more.

There are three basic ways to replace income:

Employer-paid disability insurance

This is required in most states. Most employers provide some short-term sick leave. Many larger employers provide long-term disability coverage as well, typically with benefits of up to 60 percent of salary lasting from five years to age 65 and in some cases extended for life.

Social Security disability benefits

This can be paid to workers whose disability is expected to last at least 12 months and is so severe that no gainful employment can be performed.

Individual disability income insurance policies

Other limited replacement income is available for workers under some circumstances from workers compensation (if the injury or illness is job-related), auto insurance (if disability results from an auto accident) and the Department of Veterans Affairs.

For most workers, even those with some employer-paid coverage, an individual disability income policy is the best way to ensure adequate income in the event of disability. When you buy a private disability income policy, you can expect to replace from 50% to 70% of income.

| Employer-paid disability insurance | This is required in most states. Most employers provide some short-term sick leave. Many larger employers provide long-term disability coverage as well, typically with benefits of up to 60 percent of salary lasting from five years to age 65 and in some cases extended for life. |

| Social Security disability benefits | This can be paid to workers whose disability is expected to last at least 12 months and is so severe that no gainful employment can be performed. |

| Individual disability income insurance policies | Other limited replacement income is available for workers under some circumstances from workers compensation (if the injury or illness is job-related), auto insurance (if disability results from an auto accident) and the Department of Veterans Affairs. For most workers, even those with some employer-paid coverage, an individual disability income policy is the best way to ensure adequate income in the event of disability. When you buy a private disability income policy, you can expect to replace from 50% to 70% of income. |

There are other things to consider as well when looking into disability insurance. These include:

- Short-Term vs Long-Term Policies

- Noncancelable & Guaranteed Provisions

- Additional Purchase Options

- Coordination of Benefits

- Cost of Living Adjustments

- Residual or Partial Disability Rider

- Return of Premium Provisions

- Waiver of Premium Provisions

Want to get the straight word on disability insurance?

Contact Muller Insurance to learn more about coverage throughout New Jersey, New York, Connecticut, Pennsylvania, Nevada, and other states. We are here to help.

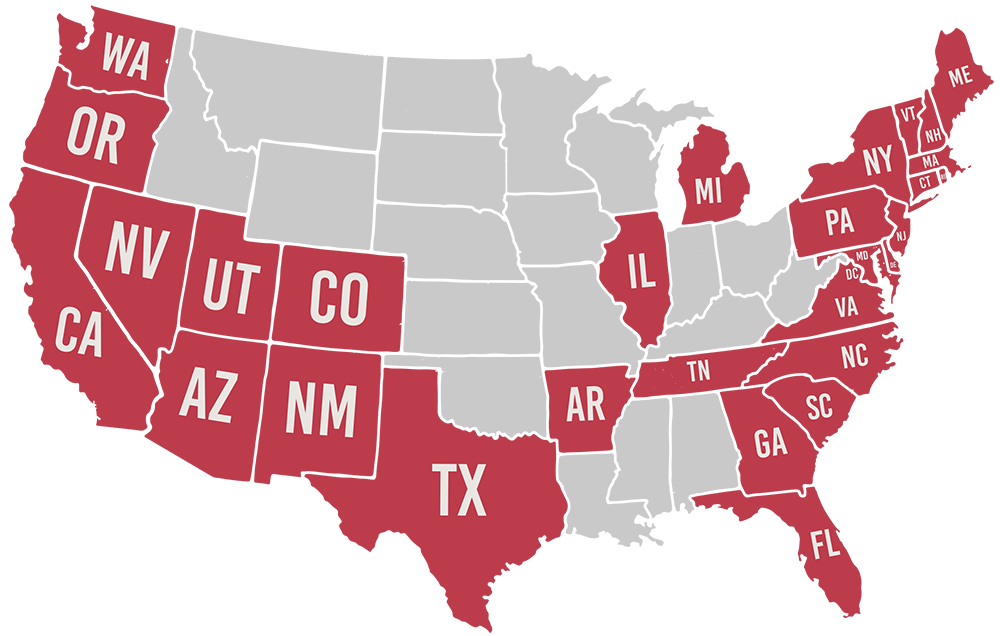

Licensed in 29 States

Additional Resources

Make Sure You Are The Only You Out There

The Federal Trade Commission processed 2.8 million fraud reports—totaling more than $5.8 billion in losses in 2021. Identity theft occurs when an unauthorized person uses your personal identifying information (e.g.,

Responsibilities for Unoccupied Condo Owners

Risk is always present when you own a condo, but it increases when the condo is left unoccupied for large portions of the year. To mitigate this, you have the

Seat Belt Laws

Finish this sentence: ‘Click it or …’ Did you say, ‘… ticket’? We have all seen and heard the public awareness campaigns on television, the radio, billboards and those portable