Insurance for Tenant-Occupied Dwellings in NJ, NY, CT, PA and Other States

A rental property is an important investment and source of income, and landlords must protect their assets against potential risks and disasters. Serving New Jersey, New York, Connecticut, Pennsylvania, Nevada, and other states, Muller Insurance offers quality landlord insurance policies that are affordable and tailored to your tenant-occupied dwelling’s needs.

Coverage Types

Tenant-occupied dwelling insurance is meant to cover buildings that are currently occupied by renters but which the landlord may not live in. Whether you own a single-family home you don’t use or a four-family rental building, tenant-occupied insurance can protect your property in the event of an accident. Our landlord insurance policies are fairly comprehensive coverage and include the following standard coverage:

- Property insurance: In the case of damage from snow, wind, hail, fire, vandalism, or related circumstances, property insurance will compensate for the cost of repairs to keep the home’s property and common areas in good condition for tenants.

- General liability: If a visitor is injured on the property or if their belongings are damaged in common areas or on the grounds, general liability will cover the cost of any resulting lawsuits.

- Loss of rent: Heavy damages to the property may force tenants to relocate until it’s repaired. This policy will compensate some of your lost income while the property is unlivable.

| Property insurance | In the case of damage from snow, wind, hail, fire, vandalism, or related circumstances, property insurance will compensate for the cost of repairs to keep the home’s property and common areas in good condition for tenants. |

| General liability | If a visitor is injured on the property or if their belongings are damaged in common areas or on the grounds, general liability will cover the cost of any resulting lawsuits. |

| Loss of rent | Heavy damages to the property may force tenants to relocate until it’s repaired. This policy will compensate some of your lost income while the property is unlivable. |

As optional add-ons, you can also choose to purchase coverage for the contents of the home. This includes any fixtures, appliances, and furniture that you own but allow your tenants to use. Additional property coverage will protect these belongings in case they’re damaged. It’s important to note that tenants will need their own renters insurance policy to protect their personal belongings and liability for events that occur within their units.

Policies We Offer

When you own a rental property, you want to be sure it offers the best possible coverage at the best prices. At Muller Insurance, our status as an independent company allows us to pick and choose from a variety of policies and providers. We’re well equipped to help you find the right policy for your needs. Our customers can utilize protection from our premier insurance partners, including Chubb Insurance, Plymouth Rock Insurance, Travelers Insurance, and The Andover Companies, or choose from numerous other options such as:

- Narrangansett Bay

- Franklin

- Farmers

- Fitchburg

- Cumberland Insurance Group

- Fidelity National

- ASI

- ACIC

- Selective and Wright Flood

- Preserver

- Tower

- Foremost

- Progressive

- Philadelphia Contributionship

- Stillwater

- Amtrust and Philadelphia Contributionship

No two landlords’ needs are alike, and our team understands what it takes to provide you with the right level of coverage. Plus, we’re committed to finding the most affordable policies possible that won’t skimp on the quality of your protection.

Choose Muller Insurance

Your rental property is an important investment and income. As a provider in New Jersey, New York, Connecticut, Pennsylvania, Nevada, and other states, we can devote the close personal attention you need to secure the right landlord insurance coverage. To learn more, contact us today and request a quote.

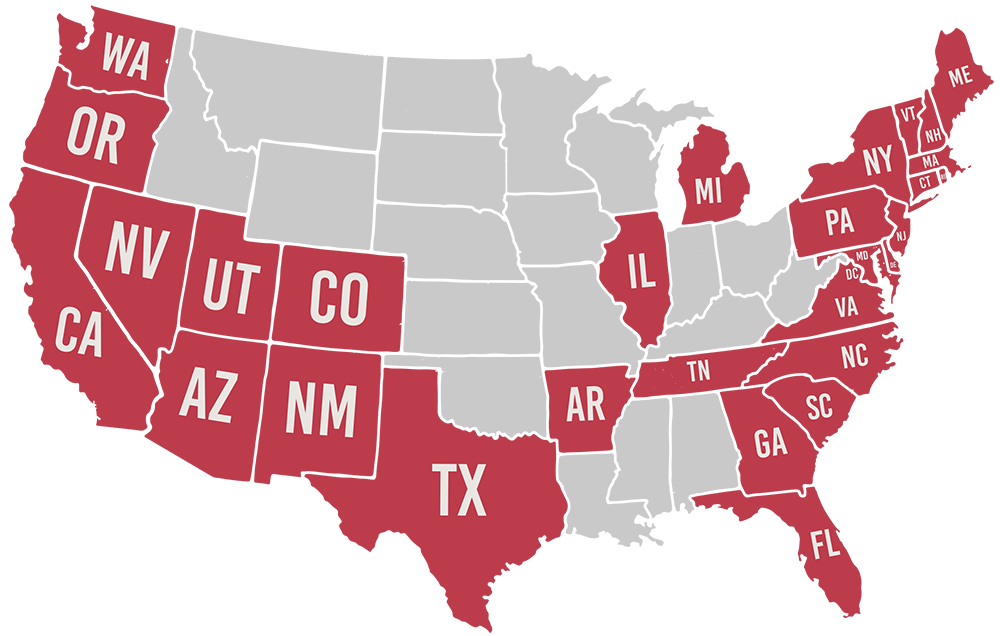

Licensed in 29 States

Additional Resources

Adding-On to Your Tenant-Occupied Insurance

Tenant-occupied insurance is designed for landlords who own a property with the intent to rent it to other people but do not live in the building themselves. As you look

Responsibility in a Multi-Family Dwelling

There are many variations of multi-family dwellings, each with their own nuances when it comes to liability. Before you buy a multi-family residential property, make sure you know the differences

Does Homeowners Insurance Cover Multiunit Dwellings?

Multiunit dwellings may require unique coverage, and several insurance options are available. Whether you’re a homeowner who’s renting out one-half of a two-family home or multiple living spaces, you need