Renters’ Insurance in NJ, NY, CT, PA and Other States

While tenants aren’t obligated to obtain the same type of insurance as homeowners, they still need the right coverage to safeguard their belongings. There are many advantages of renting, and tenants want to ensure they make the most of the renting experience with proper renters’ insurance. Renters insurance assures residents and their belongings are taken care of should an unforeseen event occur.

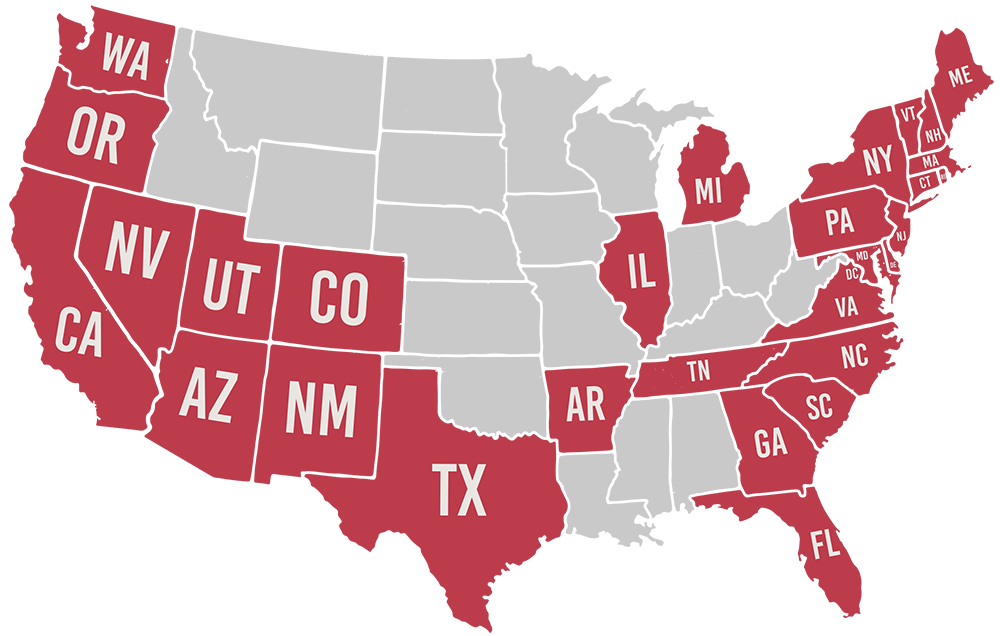

Muller Insurance is a highly respected independent agency with decades of experience. We offer affordable protection to renters in numerous states, including New Jersey, New York, Connecticut, Pennsylvania, Nevada, and more. Our team works to curate policies that align with your insurance needs, providing comfort and peace of mind at prices that fall within your budget. Learn more about our offerings for renters and how we can help you secure the coverage you need.

What Is Renters’ Insurance and What Does It Cover?

During unexpected events, a tenant’s belongings can become damaged. You may not always be able to prevent certain situations, and this is where renters’ insurance comes into play. Many tenants mistakenly assume their landlord’s insurance will protect them should damage occur on the property, but that’s not the case. The landlord’s policy covers only the structure or complex itself, and not the tenant’s personal belongings.

With renters’ insurance, if a covered event such as a storm, fire, or theft occurs, policyholders can make a claim to receive appropriate compensation for their loss. Items that are covered through renters’ insurance can include electronics, furniture, clothing, and any appliances you own. Additionally, should tenants be forced to make other living arrangements while their unit undergoes repairs, renters’ insurance helps pay for living expenses until the rental unit is livable again.

Renters’ insurance doesn’t just cover property and belongings. It’s also intended to protect people. In the unfortunate event that a visitor falls down the stairs, slips on a spill, or is bitten by a pet while visiting your rented space, you may be financially responsible for any injuries they sustain. Renters’ liability coverage pays for any medical costs and litigation expenses.

More Coverage Can Be Added

In most cases, a standard renters’ insurance policy offers tenants more than enough coverage. However, it’s important to note that not all damaging events are covered. To account for this, renters can elect to add additional coverage to their policies. Muller Insurance is pleased to extend the following protection:

Earthquake Coverage

Because most standard renters’ insurance policies don’t protect against earthquakes, people who live in an earthquake-prone region may want to invest in additional coverage.

Jewelry, Fine Arts, and Collectibles

While renters’ insurance covers your belongings, it may not be enough to protect your most valuable items. An additional policy will cover jewelry, fine arts, and collectibles, as well as other high-end items kept in your rental unit.

Umbrella Insurance

Tenants concerned about potential lawsuits beyond what a standard renters’ policy covers should consider adding umbrella insurance, which extends the limits of your liability coverage.

The Advantages of Working With Muller Insurance

Muller Insurance is proud of the strong reputation we’ve built. Our team is dedicated in providing our clients with premium policies to meet their needs. Because we’re an independent agency, we have the power to work with numerous insurance providers, ensuring our clients are getting the most advanced premiums at the most affordable rates.

Clients can take advantage of a broad range of plans from top providers of rental insurance, including Lemonade and Chubb Insurance. Other options for renters’ insurance include:

Get a Quote Today

When it comes to your belongings, don’t take any chances. Renters in New Jersey, New York, Connecticut, Pennsylvania, Nevada, and other states can secure a renters’ insurance policy from Muller Insurance to make certain their belongings are properly protected. Based on the information provided by the customer, we will offer high-quality, affordable, personalized policies that will meet your needs and budget. Additionally, our team often finds bundling opportunities and other discounts to help you save. For more information about renters’ insurance or the insurance companies we work with, contact us today or get a quote online.

Additional Resources

Tips to Prevent Roommate Theft

It’s important to protect yourself in the event your roommate is less than trustworthy. If you have a roommate, you may be a student, a young professional, or just plain

Why Every Renter Needs Insurance: Affordable Protection for Your Belongings

Renting offers flexibility and less upkeep compared to home ownership. However, it’s essential to make sure your belongings are covered with a renters’ insurance policy. At Muller Insurance, we make

Ensuring Your Guests’ Safety with Renters Insurance in New Jersey and Other States

When friends and acquaintances visit, you do everything you can to make their stay enjoyable, and the last thing you want is for anyone to get hurt or sustain damage