Umbrella Insurance in NJ, NY, CT, PA and Beyond

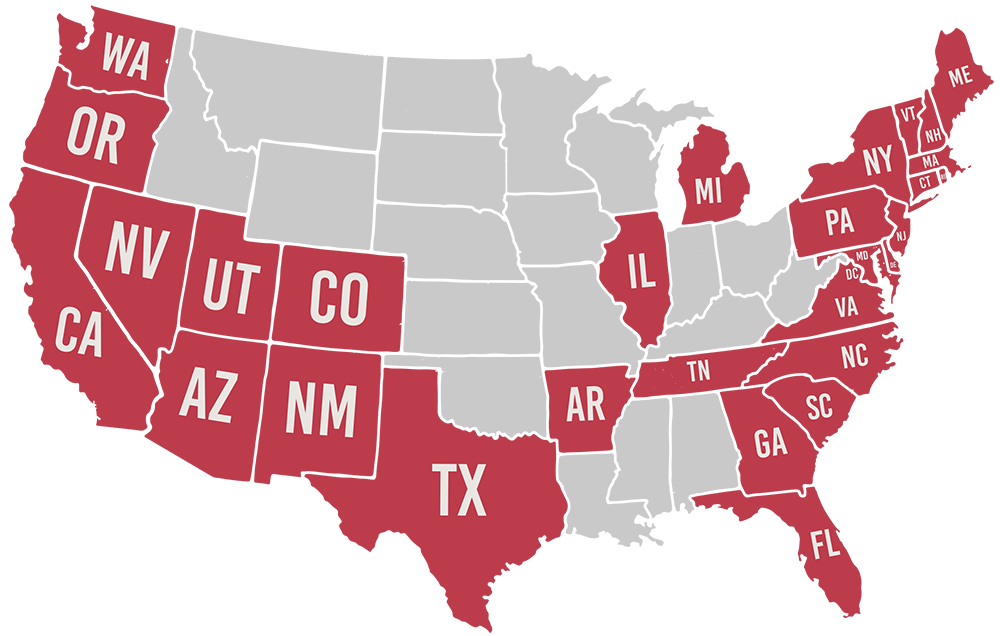

You don’t need to be a millionaire to be sued for millions of dollars. Protect yourself against lawsuits of all sizes with umbrella insurance from Muller Insurance. Our policies guard our clients against the costs associated with legal action in numerous states, including New Jersey, New York, Connecticut, Pennsylvania, and Nevada. Get in touch with our team today to begin tailoring a personalized umbrella policy to your exact needs.

What Is Umbrella Insurance?

Umbrella insurance is an extension of your liability policy. For instance, when someone falls down your front steps, is bit by your dog, or gets involved in an accident with your vehicle, you may be held legally responsible for their damages. Auto and homeowners insurance policies only go so far to protect you. Umbrella insurance covers the gap, helping you pay legal fees and court judgments without losing your savings.

A lawsuit can take everything you own and impact your future earnings, so it’s wise to make sure you are covered against anything that poses a risk to you or others. The following are examples of causes of lawsuits that umbrella policies can cover:

- Owning a home

- Vacation properties

- Waterfront properties

- Vacant land

- Luxury automobiles

- Motorcycles, watercraft, and recreational vehicles

Additional Types of Coverage

As with any insurance policy, it’s important to understand what your plan covers. Umbrella insurance is typically available in increments of $1 million, and the details of coverage depend on the company and specifics of your plan. Depending on your needs, you should consider the following additional coverage types:

- Libel, slander, and character defamation

- Privacy invasion and hacking

- False arrest

- Coverage for people who reside with you

- Coverage for recreational vehicles and watercraft

If you are concerned about any of the above, invest in an umbrella policy that includes the proper coverage.

Finding the Right Umbrella Insurance for You

Muller Insurance works with dozens of top providers across the nation. Our premier partners include big names like Chubb Insurance, Plymouth Rock Insurance, Travelers Insurance, Safeco, and The Andover Companies. We also offer plans from a long list of other reputable companies, including Lemonade, AIG, Franklin Insurance Agency, Farmers Insurance, Fitchburg Mutual Insurance Company, Federal Insurance Company, Norfolk & Dedham Group, Great Northern Insurance Company, Merrimack Insurance & Retirement Planning Services, Bay State Insurance Company, Progressive, Cumberland Mutual, Fidelity National Financial, and more.

As an independent agency, we can offer more options and better flexibility. We’ll work with you to choose between our many providers and plans to find the one that best fits your needs. More importantly, we’re committed to keeping it affordable. With the help of Muller Insurance, you can find a policy that offers the protection you want at prices you can easily meet.

Choose Muller Insurance for Your Umbrella Coverage

Based in New Jersey, Muller Insurance provides high-quality affordable policies to clients throughout New Jersey, New York, Connecticut, Pennsylvania, Nevada, and many other states as well. Take the first steps toward peace of mind by contacting us today and requesting a quote on an umbrella insurance policy.

Additional Resources

Your Dog May Impact Your Premium

Dogs come in all shapes and sizes The American Kennel Club has recognized a staggering 195 dog breeds. Despite that, all dogs—whether a chihuahua or a bull mastiff—come from the

How Much Umbrella Insurance Do I Really Need?

Insurance provides us with peace of mind. It allows us to relax in our homes even with inclement weather on the way. It lets us feel comfortable as we get

Umbrella or Condo Insurance?

A kitchen fire. A guest’s slip-and-fall injury. A burst pipe. Condo ownership comes with a number of risks, and all of them can take a toll on your finances without