Insurance for Apartment Buildings in NJ, NY, CT, PA and Beyond

There are many benefits to investing in rental property, but there are just as many risks. A wide range of situations can arise at any time that may compromise your rental income and your business. If you’re located in New Jersey, New York, Connecticut, Pennsylvania, Nevada or others, you can protect yourself and your investment with apartment building insurance from Muller Insurance. Our policies give our customers the peace of mind that their properties are protected, and when something goes wrong, we’ll be there to help.

Protection for Apartment Building Owners

Owning a rental property comes with a variety of risks. At any time, your apartment building – and your rental income – can be threatened in any number of ways. Our apartment building packages cover the following threats and more:

- Smoke and fire

- Wind, snow, and hail

- Theft and vandalism

- Building code issues

- Legal liability

Many building owners also choose to bundle their insurance packages with additional coverage for sewer systems and water backup.

Our Apartment Building Policies

At Muller Insurance, we offer two types of policies that provide the coverage you need when your property is damaged or cannot be used to generate income. We cater to properties of all sizes and capacities and can help you choose the right policy for your unique situation. Our policy options include:

Residential Building Coverage

Meant for residential apartment buildings, these policies provide coverage in the following situations:

- Accidental or malicious damage to the building

- Loss of rental income due to extensive damages

- Liability for damages or injuries that occur in common areas of the property

- Sewer drains clogging or backing up to cause flooding

Mixed-Use Building Coverage

These complex policies are unique to mixed-use buildings that combine residential and retail units. There are many nuances to consider, and Muller Insurance will help you understand which apply to your property so you can secure the right coverage. These policies cover:

- Loss or damage to merchandise and signage for owner-occupied retail property

- Retail liability coverage in the case of injuries to customers and clients

- Compensation for the breakdown of mechanical equipment and computers

| Residential Building Coverage | Meant for residential apartment buildings, these policies provide coverage in the following situations:

|

| Mixed-Use Building Coverage | These complex policies are unique to mixed-use buildings that combine residential and retail units. There are many nuances to consider, and Muller Insurance will help you understand which apply to your property so you can secure the right coverage. These policies cover:

|

Over a Century of Trusted Service

No two apartment buildings are alike, and as a locally operated and independent insurance agency, we’re dedicated to providing the personalized guidance national agencies simply can’t offer. Serving New Jersey since 1906, Muller Insurance will get to know your business and what makes it unique so we can find the right policies for you and tailor them to your needs.

Our close attention doesn’t just get you access to the best policies, either. We also provide the unrivaled, local customer service. When we know your business in and out, we can answer questions, adjust packages, or respond to claims swiftly and with a personal level of knowledge and care that you can’t find elsewhere.

Reach Out to Muller Insurance

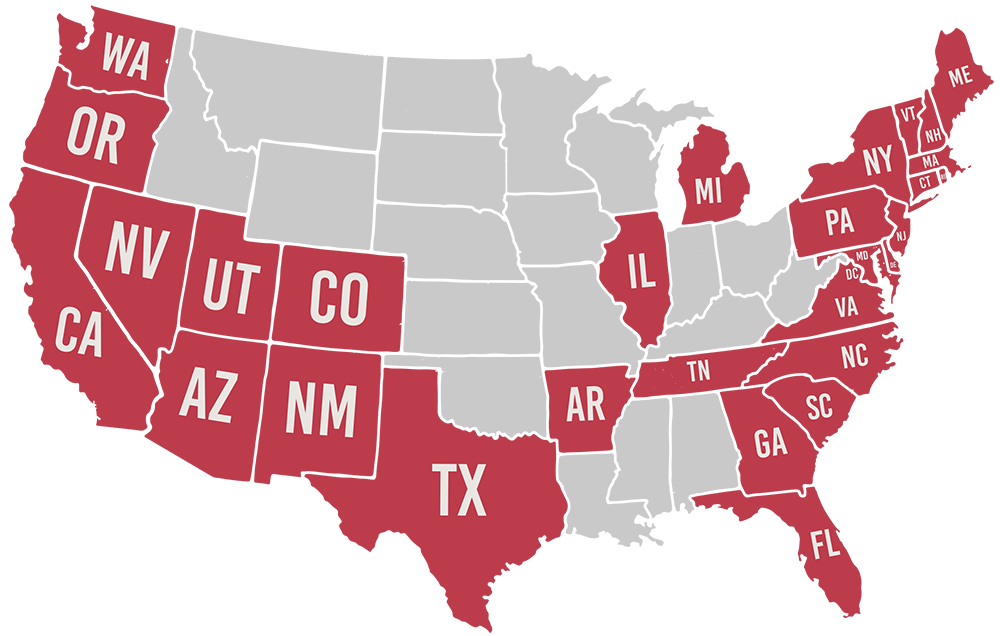

Don’t put your income and investment at risk by letting your apartment building go unprotected. Muller Insurance will guide you to the quality apartment building insurance policies and affordable rates you need. We even offer discounts for properties with sprinkler systems, fire-resistive technologies, new construction, and more. Muller Insurance works with many insurance providers, including trusted companies like The Andover Companies, Franklin Mutual, Farmers of Salem, Cumberland Mutual and many others. If your building is located in New Jersey, New York, Pennsylvania, Connecticut, Nevada or in one of the 25 states we are licened, get started by contacting us today for a free quote.

Licensed in 29 States

Additional Resources

Needed Coverage for a Mixed-Use Apartment Building

In a mixed-use apartment building, it can often be difficult to figure out which parties are liable for damage, injury, and more. That’s why it’s helpful to know exactly what

Responsibility in a Multi-Family Dwelling

There are many variations of multi-family dwellings, each with their own nuances when it comes to liability. Before you buy a multi-family residential property, make sure you know the differences

Mixed-Use Apartment Building Insurance

If you’ve seen more buildings in your area with a mix of apartments above and retail or other commercial spaces below, you’ve noticed the rise in mixed-use apartment buildings. These