Condo Insurance in NJ, NY, CT, PA and Other States

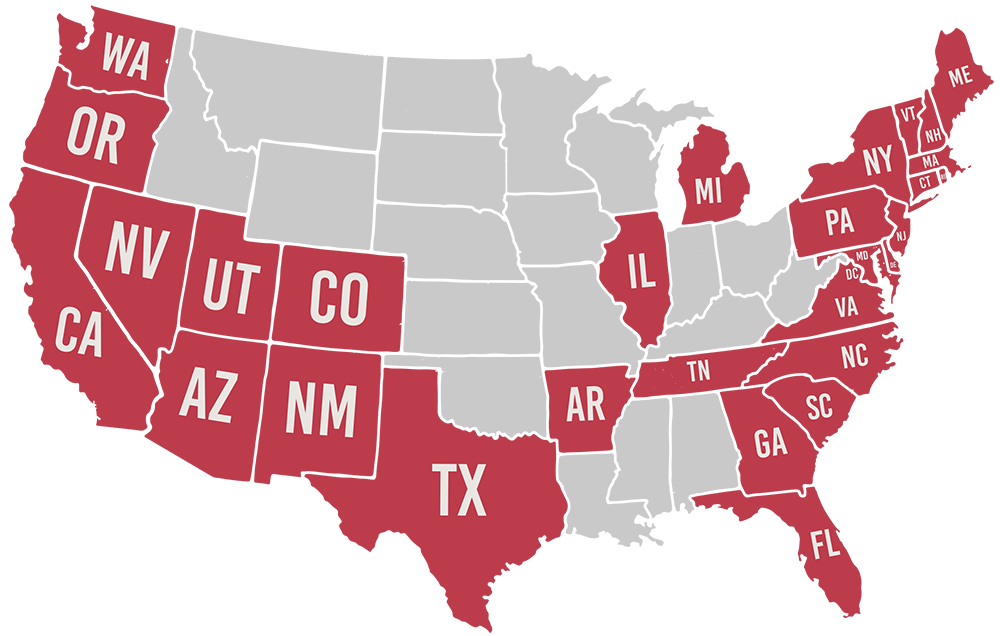

Your condo is your home, and it can be a great investment. Because you own your condo, just like you might own a house, it’s important to protect it with insurance. Serving New Jersey, New York, Connecticut, Pennsylvania, Nevada, and other states, Muller Insurance offers affordable condo insurance policies that can be tailored to your specific needs.

What Does Condo Insurance Cover?

Condominium insurance covers everything within your unit, including personal possessions, such as clothing, furniture, artwork, and appliances. It also covers the interior structures of the unit, including walls and cabinetry.

Condo insurance obtained through Muller Insurance also provides liability coverage. If someone slips and falls and is injured inside your condo, you’ll have monetary protection.

Generally, condo owners are not responsible for common areas of the building, such as elevators and lobbies. These areas are covered by the condo association’s insurance policy.

What Additional Coverage Options Are Available For Condo Owners?

While standard condo insurance may be all that most owners need, some can benefit from additional types of condo insurance policies. If special circumstances apply to your situation, you may want to consider:

- Water and sewer backup coverage: Muller Insurance offers this type of protection, which covers personal property that is damaged by an overflowing drain or broken sump pump. This type of damage is not something that is covered by most other companies.

- Unit assessment: This additional coverage reimburses you for your share of an assessment charged to all unit owners as a result of a covered loss.

- Umbrella liability: This broadens your coverage at an affordable rate.

- Flood and earthquake coverage: If you live near a body of water or your condo is located in an area prone to earthquakes, the condo association most likely has flood and earthquake coverage already in place for the entire building. If the association does not offer this coverage, however, consider adding earthquake coverage to your condo insurance policy and investing in an additional flood insurance policy.

- Floater or endorsement coverage: If you own valuables, such as high-end furs, jewelry, or collectibles, you may want to increase your coverage, as reimbursements on standard policies may have limits as low as $1,000.

| Water and sewer backup coverage | Muller Insurance offers this type of protection, which covers personal property that is damaged by an overflowing drain or broken sump pump. This type of damage is not something that is covered by most other companies. |

| Unit assessment | This additional coverage reimburses you for your share of an assessment charged to all unit owners as a result of a covered loss. |

| Umbrella liability | This broadens your coverage at an affordable rate. |

| Flood and earthquake coverage | If you live near a body of water or your condo is located in an area prone to earthquakes, the condo association most likely has flood and earthquake coverage already in place for the entire building. If the association does not offer this coverage, however, consider adding earthquake coverage to your condo insurance policy and investing in an additional flood insurance policy. |

| Floater or endorsement coverage | If you own valuables, such as high-end furs, jewelry, or collectibles, you may want to increase your coverage, as reimbursements on standard policies may have limits as low as $1,000. |

Depending on your circumstances, these optional add-ons can help protect you from the serious consequences of unexpected hazards.

We’ll Find the Right Condo Insurance for You

We understand you want the best coverage at the best price. Muller Insurance is an independent agent, which allows us to choose policies and providers that are tailored to meet your individual needs. Our premier insurance partners include Chubb Insurance, Plymouth Rock Insurance, Travelers Insurance, Safeco, and The Andover Companies. We also offer plans from Lemonade, AIG, Franklin, Farmers, Fitchburg, Federal, Norfolk and Dedham, Great Northern, Merrimack, Baystate, Progressive, Cumberland Insurance Group, Fidelity National, and a long list of other top-quality insurance companies.

We’re committed to finding you the right condo insurance plan at an affordable price.

Choose Muller Insurance for Your Condo Coverage

Your condo is a major investment and the place you call home. Protect it with condo insurance from Muller Insurance. We provide quality, affordable coverage, and professional service, and we’re dedicated to helping condo owners in New Jersey, New York, Connecticut, Pennsylvania, and Nevada, as well as other states, enjoy the peace of mind that comes with knowing their investment is protected. To learn more, contact us today at 201-659-2403 to request a quote.

Additional Resources

Responsibility in a Multi-Family Dwelling

There are many variations of multi-family dwellings, each with their own nuances when it comes to liability. Before you buy a multi-family residential property, make sure you know the differences

Does Your Condo Association Have Enough Insurance Coverage?

Condo associations require comprehensive insurance coverage to protect their buildings and common areas. However, many associations overlook critical details in their insurance policies, leaving gaps that can lead to costly

Handling Uninsured Condo Owners

Operating a building with condos offers stability from the tenants and a steady stream of rent. However, if the tenants are allowed to rent the condos instead of own them,