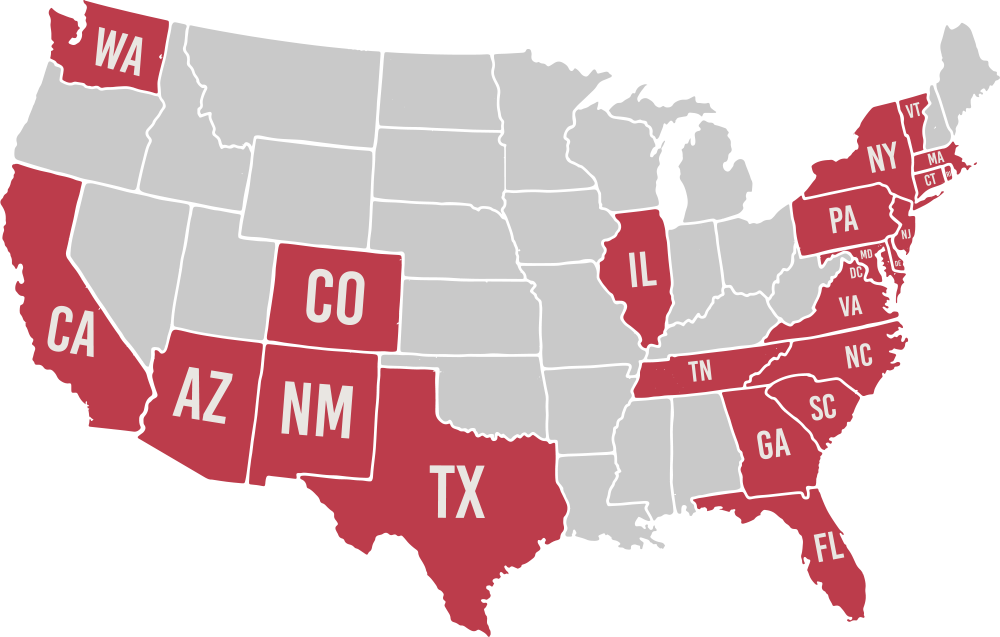

Homeowners Insurance in NJ, NY, CT, PA, MD, and 20 Other States

Your home is your shelter. It protects you while you make lasting memories with your family. And it’s one of the largest investments that most people own. Protect your investment with an affordable homeowners insurance policy from Muller Insurance. We are an independent insurance agency serving New Jersey, New York, Connecticut, Pennsylvania, Nevada, and other states, which means we can tailor your policy to meet your needs by offering plans from a wide array of top-quality insurance providers.

What Does An Homeowners Insurance Policy Cover?

Standard homeowners insurance policies will cover damage to your home as well as the property inside, such as clothing, furniture, jewelry, and more. In the event of a disaster, such as a fire, the policy will pay the cost to rebuild your home and replace your possessions. It also protects you from being liable for the damage you may cause to other people’s property. Muller Insurance policies are written on a replacement cost basis, meaning they cover rebuilding your home or replacing your possessions without a deduction for depreciation.

It is important to note that standard homeowners insurance policies will not reimburse you for damages caused by flooding, sewer backups, mold, earthquakes, or termites. And they will not cover you if someone is hurt in your swimming pool or on your trampoline. Coverage for these situations requires additions to policies that aren’t always offered. Muller Insurance offers additional coverage for damage to property caused by sewer and drain backups as well as other add-ons, like earthquake insurance and umbrella liability, so you get the protection that’s right for you. Flood insurance is also available as a separate policy.

What Are The Basic Homeowners Insurance Options?

There are several main types of homeowners insurance that are meant to address a wide variety of needs. These standard policy types include:

- HO-3: This standard homeowners insurance plan covers your house and your property within your house from all perils, except for those that are specifically excluded, such as flooding and earthquakes.

- HO-4: This is a homeowners policy that’s technically not for the homeowner, but exclusively for renters. It protects a renter’s personal property, but does not cover the rental property itself.

- HO-5: The HO-5 policy is similar to the HO-3, however, broader coverage applies. The property must meet certain qualifications.

- HO-6: This is condo insurance. It protects the condo owner’s personal property and the structure of their individual unit.

Muller Insurance is here to assist you with choosing the best option for your circumstances. We offer quotes that are tailored to your needs thanks to our partnership with a long list of top-quality insurance providers. We’ll guide you through your options to help you determine whether you require more than a standard homeowners insurance policy.

| POLICY | DESCRIPTION |

|---|---|

| HO-3 | This standard homeowners insurance plan covers your house and your property within your house from all perils, except for those that are specifically excluded, such as flooding and earthquakes. |

| HO-4 | This is a homeowners policy that’s technically not for the homeowner, but exclusively for renters. It protects a renter’s personal property, but does not cover the rental property itself. |

| HO-5 | The HO-5 policy is similar to the HO-3, however, broader coverage applies. The property must meet certain qualifications. |

| HO-6 | This is condo insurance. It protects the condo owner’s personal property and the structure of their individual unit. |

Muller Insurance is here to assist you with choosing the best option for your circumstances. We offer quotes that are tailored to your needs thanks to our partnership with a long list of top-quality insurance providers. We’ll guide you through your options to help you determine whether you require more than a standard homeowners insurance policy.

What Homeowners Insurance Add-Ons That Will Further Protect You?

Depending on your situation, there are some available insurance add-ons that can save you from the severe consequences of unforeseen disasters.

If you live in a designated flood zone, such as in a coastal region or near a river, it’s a good idea to look into buying flood insurance – especially if you own a swimming pool. Likewise, if you live in an earthquake-prone area, you may want to consider earthquake insurance.

Many standard policies don’t cover damage to property caused by sewer backups and drain problems. This is one of those add-ons that Muller Insurance offers that brings just a little more peace of mind to our clients.

If you own fine art, jewelry, or collectibles, we offer special coverage for these treasures, as standard homeowners insurance typically has low limits for items like stolen jewelry.

Finally, there is a wide variety of reasons you might want to consider an umbrella liability policy. Owning a swimming pool, a luxury automobile, a waterfront property, or a boat can put you at risk for being sued for more than what a standard homeowners insurance policy will cover. This type of insurance can help protect you from losing everything you own.

We’ll Find the Right Homeowners Insurance to Meet Your Needs

We know you only want the coverage you need and at a fair price. Muller Insurance works with premier insurance partners, including Chubb Insurance, Plymouth Rock Insurance, Travelers Insurance, and The Andover Companies, in order to provide the best options to our clients. As an independent agent, we can offer plans from Baystate, Cumberland Insurance, Farmers, Federal, Fidelity National , Fitchburg, FMI (Franklin Mutual), Foremost, Great Northern, Lemonade, Merrimack, Narragansett Bay Insurance, Nat Gen, N&D (Norfolk and Dedham), Progressive, Stillwater, The Philadelphia Contributionship, Typ Tap , and a long list of other top insurance companies.

Trust Muller Insurance to Protect Your Home and Personal Property

Protect your home and personal belongings with a homeowners insurance policy from Muller Insurance. We are dedicated to helping the residents in New Jersey, New York, Connecticut, and Pennsylvania, Nevada, as well as other states, to enjoy the peace of mind that comes with protecting their homes and families. To learn more, contact us today at 201-659-2403 to request a quote.

Additional Resources

Your Dog May Impact Your Premium

Dogs come in all shapes and sizes The American Kennel Club has recognized a staggering 195 dog breeds. Despite that, all dogs—whether a chihuahua or a bull mastiff—come from the

Preparing Your Property for Hurricane Season

Now is the time to prepare! The Atlantic hurricane season runs from June 1-Nov. 30. With winds over 75 mph, hurricanes can turn almost anything into a destructive projectile. When

Play It Safe with the Proper Coverage

Who needs an umbrella in the summer? You do! An umbrella insurance policy that is! The lazy days of summer means school is out and playground season is in full