Life Insurance Policies in NJ, NY, CT, PA and Beyond

Life insurance is a cornerstone in protecting your family’s well being. Even if you have it, it can get dated quickly. That’s why it is important to review and possibly update your policy with a professional every two years.

The right policy is always a sound investment. It can provide:

- Replacement income for dependents

- Cover burial and funeral costs

- Create an inheritance for your heirs

- Pay federal “death” taxes and state “death” taxes

- Make significant charitable contributions

- Create a source of savings

Types of Life Insurance

Not all life insurance is the same. There are, in fact, two major types of life insurance—term and whole life. Whole life is sometimes called permanent life insurance. It encompasses several subcategories, including traditional whole life, universal life, variable life and variable universal life.

Term

Term Insurance is the simplest form of life insurance. It pays only if death occurs during the term of the policy, which is usually from one to 30 years. Most term policies have no other benefit provisions. There are also two basic types of term insurance polices—level terms and decreasing term.

Level term means that the death benefit remains the same throughout the duration of the policy. Decreasing term means that the death benefit drops, usually in one-year increments, over the course of the policy’s term.

Whole Life/Permanent

Whole life or permanent insurance pays a death benefit whenever you die—even if you live to 100! There are three major types of whole life or permanent life insurances—traditional whole life, universal life, and variable universal life.

Want to get the straight word on life insurance?

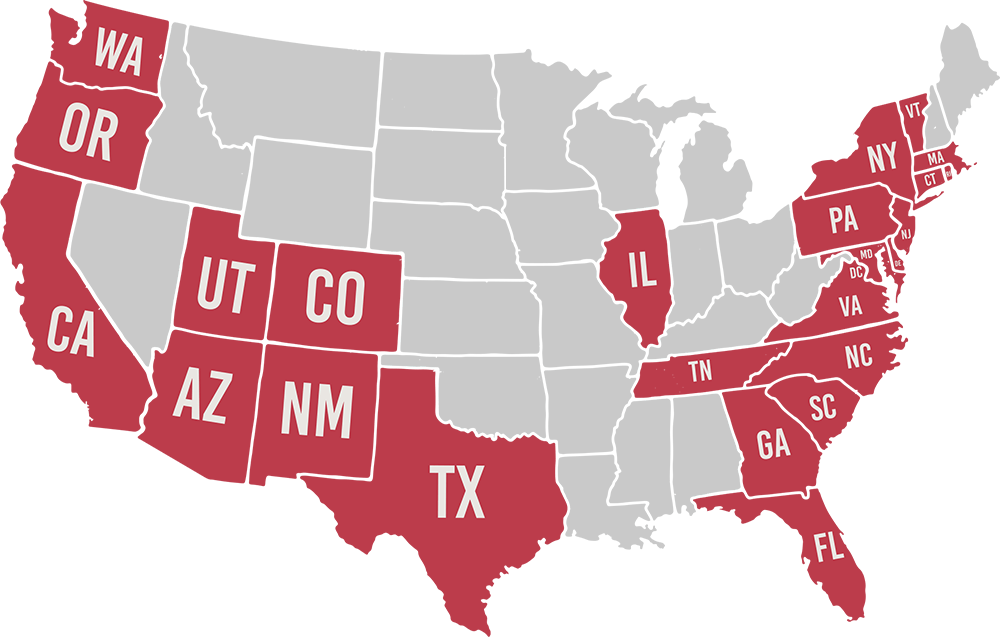

Contact Muller Insurance to learn more about coverage throughout New Jersey, New York, Connecticut, Pennsylvania, Nevada, and other states. We are here to help.

Licensed in 25 States

Additional Resources

Risks of Condo Associations that Cannot Be Overlooked

Keeping a condominium running and residents happy isn’t easy. That’s why most communities rely on a condo association to manage day-to-day affairs. Made up of unit owners within the property,

Rebuilding After Disaster

We all hope to never experience serious damage to our homes due to fire, flooding, or natural disasters. However, when the worst occurs, your homeowner’s insurance will make it possible

What Tenant-Occupied Insurance Does and Doesn’t Cover

Owning a rental property is a great source of income, but it’s also a risky endeavor. While it’s possible to insure against those risks, there can be some confusion about