Condo Association Insurance in NJ, NY, CT, PA and Beyond

Condominium associations have unique insurance needs. While unit owners are responsible for their condos, common areas are in the hands of the association. Without the right insurance policy, associations might be faced with uncovered liabilities and losses for damages occurring in common spaces. For the ultimate protection, Muller Insurance offers trusted coverage to condo associations throughout New Jersey, New York, Connecticut, Pennsylvania, Nevada, and many other states.

Definition of Coverage Areas

Without comprehensive insurance, everyone in the association – from condo owners to co-op shareholders and residents – is at risk in the areas it’s responsible for. But what areas are covered under a condo association insurance policy? Generally, these policies protect structures and areas that benefit all residents, including:

Common Areas

Condo association insurance covers the common areas of a condo unit. This includes:

- Garages and carports

- Recreational areas, like pools, gyms, gazebos, and tennis courts

- Other outdoor areas, such as porches, decks, patios, and balconies

Shared Infrastructure

This insurance covers structures that are shared throughout the building, including the foundations, utilities, and security systems. It also includes bare walls, hallways, elevators, and staircases.

Cooperatively Owned Property

Finally, condo association insurance covers any property owned by the co-op shareholders, even if it is not part of the building. If the co-op owns any furniture, artwork, rugs, blinds, signs, or landscaping, those elements are covered as well.

Remember that condominium association insurance does not cover the inside of individual condo units. Condo owners are responsible for insuring their units, furniture, and appliances with a condo insurance policy. At the time of a claim, the bylaws will ultimately determine the responsibility of the condo association’s coverage.

Scope of Coverage

For over a century, Muller Insurance has been helping people throughout New Jersey secure the right amount of insurance coverage for their needs. When it comes to condo associations, we offer policies that cover the complex’s grounds from a variety of common threats and shield parties involved from loss. Coverage includes:

- Fire and smoke damage

- Lightning, hail, and wind damage

- Sprinkler leakage

- Water damage from a roof leak or a pipe break

- Vandalism and theft

- Liability

Condo association coverage also protects you from potentially expensive lawsuits should bodily injury or property damage occur. Condominium complexes often have features that put them at higher risk, like pools, hot tubs, fitness centers, tennis courts, and high balconies. If an injury occurs in an insured area, condo associations can be assured their legal fees and judgments will be covered in the event of a lawsuit for failing to meet their responsibilities.

Why Choose Muller Insurance?

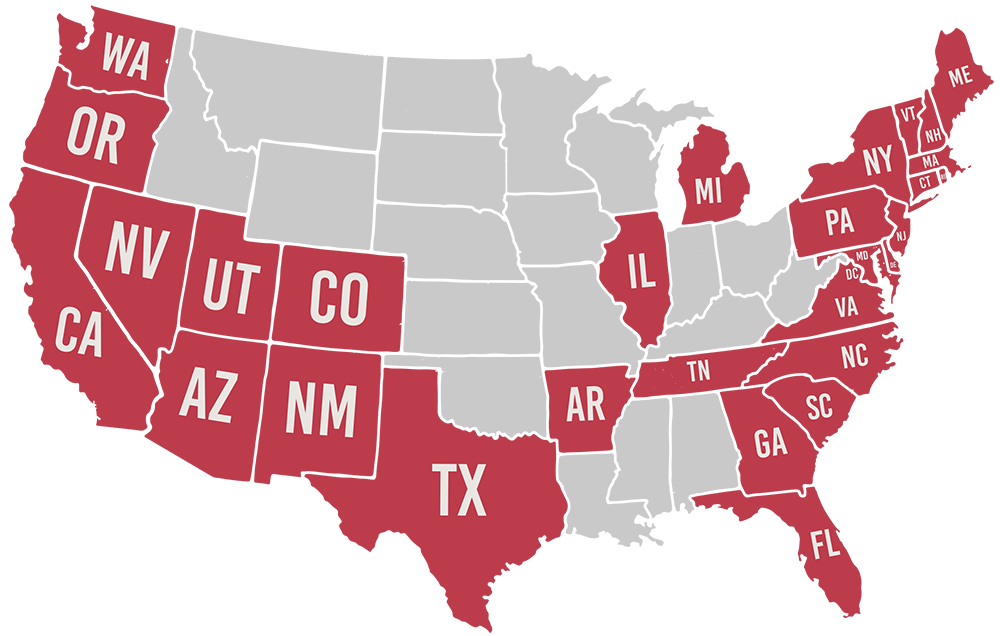

Since 1906, Muller Insurance has been serving New Jersey with our commitment to providing high-quality policies at affordable costs. Also offering coverage to clients in additional states such as New York, Connecticut, Pennsylvania, Nevada, and beyond, we work with over 20 insurance providers to ensure each client has their specific needs met. That means a condo association insurance policy from Muller Insurance will provide the exact amount of protection your association and buildings need. We even cover things that other insurers can’t promise, like sewer backup.

Also, our competitive condo association insurance can be purchased as a part of a commercial package policy. Beyond covering your complex, this includes coverage for workers’ compensation, as well as directors’ and officers’ liability. Muller Insurance works with many insurance providers, including trusted companies like The Andover Companies, Franklin Mutual, Farmers of Salem, Cumberland Mutual, Liberty Mutual, N&D Group and many others. For more information about our policies for condo associations, contact us today for a free quote.

Licensed in 29 States

Additional Resources

Condo Association Common Area Responsibilities (And Risks)

In a condo, the condo association is responsible for the maintenance, operation and oversight of all common areas. If not properly taken care of and covered through insurance, they may

What Is Covered By Condo Association Insurance (Master Condo Policy)?

Condo communities are based on a unique structure, sharing communal property and individual living units in the same buildings. This structure complicates insurance coverage, which must be carried by condo

Condo Association Insurance: What Every HOA Board Needs to Know

Condominiums often have unique insurance needs, including policies that are the occupant’s responsibility and those that must be obtained by the condo association. Muller Insurance is an independent insurance agency